-

HOME

HOME - /

- UAE

- /

- BANKING

How to choose the best Credit Cards in UAE for Low Salary workers without annual charges - Full Guide

Are you looking for Credit card in UAE? Having a good credit limit credit card in UAE is everyone's will but some people who are low monthly earners struggling to find out the best banks which can provide them a best credit card for their low monthly salary.

Finding our the right bank which can provide you the best card which is made for you is not an easy task.

UAE has several bank including private Financial organizations which can provide the credit card to you but you will not get the best credit limit or offers card without having knowledge and comparing the several cards.

Here are some best Credit cards with No Annual fee means they are life time free and best offers I find out

for you.

Have a look in such a less time and no need to visit every bank website and reading the whole pages about the

credit cards.

I hope you will find out the best credit card for you if you are a low salary person in UAE

Emirates NBD

Emirates NBD Go for Gold Card

MINIMUM SALARY

AED 6000

RATE

3.25%

ANNUAL FEE

AED 0.00

SALARY TRANSFER

No

OTHER KEY BENEFITS

- Cinema Tickets

- Dining Offers

- Health & fitness

- Balance Transfer

- Contactless tech

REASON TO CHOOSE

- Free for life card

- 0% Installment plan

- Airport Lounge Access

- No annual Charges

- Auto NOL card Top up

OTHER FEATURES OF THE CARD

- Instant cash : Quick access to upto 90% of your credit limit.

- 0% installments on your purchase of selected outlets.

- Complimentary access of over 1000 lounges worldwide.

- Pay your DEWA or Etisalat utilities bills online.

- Earn upto 5 Plus points for every AED 200 spend on weekends.

- Shop with your credit card on Skyshopper.com and get back 5% on Electronics, Groceries & more.

- Auto top up your NOL card tag ID and ferry rides on dubai ferry & movie ticket discount monthly.

CITI Bank

Citi Simplicity Credit card

MINIMUM SALARY

AED 5000

RATE

3.50%

ANNUAL FEE

AED 0.00

SALARY TRANSFER

No

OTHER KEY BENEFITS

- Balance transfer

- Dining Offers

- Health & fitness

- Contactless tech

REASON TO CHOOSE

- Free for life card

- Cash loan on credit card

- Airport Lounge Access

- No annual Charges

- Easy installment plan

OTHER FEATURES OF THE CARD

- No annual fee,cash advance fee or overlimit fee ever.

- Access of selected airport lounge across Middle east.

- 50% off on food delivery and dine in bills with 50 free voucherskout credit.

- One click instant cash loan.

- Easy installment plan for any big purchase on cards.

- Contactless technology with safety and privacy, across the world customer care support for free.

Mashreq bank

Mashreq Cashback Credit Card

MINIMUM SALARY

AED 5000

RATE

3.25%

ANNUAL FEE

AED 0.00

SALARY TRANSFER

No

OTHER KEY BENEFITS

- AED 500 Cashback

- Instant Digital card

- Health & fitness

- Balance Transfer

- Contactless tech

REASON TO CHOOSE

- Free for life card

- 5% cashback on Dining

- Airport Lounge Access

- No annual Charges

- Auto NOL card Top up

OTHER FEATURES OF THE CARD

- You can get instant Digital card online immediately.

- AED 500 cashback on your card as new customer

- 5% cashback on your dinning in UAE.

- 1% cashback on your local Expenses.

- 2% cashback on your International Expenses.

- 20% cashback on Noon, Etisalat & Talabat

- Auto top up your NOL card tag ID and ferry rides on Dubai ferry & movie ticket discount.

Emirates Islamic Bank

Emirates Islamic Union Coop Tamayaz Card

MINIMUM SALARY

AED 5000

RATE

3.49%

ANNUAL FEE

AED 0.00

SALARY TRANSFER

No

OTHER KEY BENEFITS

- Valet Parking

- Cinema Tickets

- Balance Transfer

- Purchase Protection

- Golf Offers

REASON TO CHOOSE

- Free for life card

- Free valet parking

- Welcome Bonus

- Extended Warranty

- Global Assistance

OTHER FEATURES OF THE CARD

- One free valet parking free every month at selected locations.

- Welcome bonus of 6000 Tamayaz points

- 3 tamayaz Points on Every One dirham Spent at Union Coop stores.

- 80% Cash withdrawn facility of credit card limit

- Emirates islamic Union Coop Tamayaz card is fully Shari's compliant

- No interest charges on this card

- Entitles you to emergency Medical and Legal assistance anywhere in the world through SOS Int'l.

Emirates Islamic Bank

Emirates Islamic RTA Credit Card

MINIMUM SALARY

AED 5000

RATE

3.49%

ANNUAL FEE

AED 0.00

SALARY TRANSFER

No

OTHER KEY BENEFITS

- Inbuilt NOL chip

- Purchase protection

- Golf offers

- Mazaya offers

REASON TO CHOOSE

- Free for life card

- 2.25% cashback

- 10% cashback on RTA

- Extended Warranty

- 10% cashback on fuel spend

OTHER FEATURES OF THE CARD

- RTA NOL & SALIK auto top up facility

- Emergency Legal and Medical referral service

- You can use your credit card as NOL card at RTA transport.

- Luxury hotel collection offers directly from VISA

- 1.25% cashback on Other Expenses

- purchase protection on purchase using this card

- Discounts in several Golf courses across the World using this RTA card of Emirates Islamic.

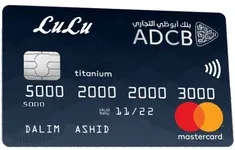

Abu Dhabi Commercial Bank

ADCB LULU Titanium Credit Card

MINIMUM SALARY

AED 5000

RATE

3.25%

ANNUAL FEE

AED 0.00

SALARY TRANSFER

No

OTHER KEY BENEFITS

- Air Miles

- No annual fee

- Balance Transfer

- Credit shield

REASON TO CHOOSE

- Airport lounge Access

- 3.5 lulu points per AED 1

- 55 Interest free days

- cash loan on credit card

OTHER FEATURES OF THE CARD

- Interest free balance transfer within 90 days of card registration

- Credit shield with complimentary life cover

- 0% Interest on school fee payments.

- Convenient payment options via online or cash deposit machines.

- Buy 1 get 1 free across middle east and africa dining and spas from mastercard

- Redeem LuLu points at any LuLu Shopping mall.

- You can get benefits at Yas waterworld and Ferrari world using this Titanium card.

First Abu Dhabi Bank

FAB Abu Dhabi Titanium Card

MINIMUM SALARY

AED 5000

RATE

3.75%

ANNUAL FEE

AED 0.00

SALARY TRANSFER

No

OTHER KEY BENEFITS

- Air Miles

- No Annual fee

- Balance Transfer

- Credit shield

- Cinema Tickets

REASON TO CHOOSE

- Free for Life

- 20% off on Careem ride

- Roadside Assistance

- Dining Offers

- Zero paperwork

OTHER FEATURES OF THE CARD

- AVIS car rental discounts

- Earn 2.5 FAB rewards for every aed 1 Spend

- 25% Extra FAB Rewards for spending in Abu Dhabi

- 10% cashback all year round at leading global online stores.

- 600+ offers available across multiple countries.

- Complimentary access to over about 10 VIP lounges in Saudi Arabia, UAE, Egypt, Kuwait and Jordan.

RAK BANK

RAK Bank Kalyan Jwellers Credit card

MINIMUM SALARY

AED 5000

RATE

3.45%

ANNUAL FEE

AED 0.00

SALARY TRANSFER

No

OTHER KEY BENEFITS

- 7% Goldback

- No Annual fee

- Balance Transfer

- Low Interest

REASON TO CHOOSE

- Free for Life

- free supplementary cards

- Free purchase protection

- Free travel Accident Insu.

OTHER FEATURES OF THE CARD

- low interest rates on outstanding retail purchase

- Upto 55 days Interest free credit time

- Free supplementary cards

- Cash advance upto 80% of your credit limit

- Just 3% of minimum payment of all of your outstanding.

- 0% easy Installment plan on Diamond and Gold jewelry across the world.

- Enjoy upto 30% discount at over 2000 restaurants with RAK foodie using your RAK Kalyan card.

Important Note: Be careful while choosing the credit card for you. Some banks show the no annual fee for credit card but they have the condition of minimum spend per month. So i will suggest you the only above credit cards which has no annual fee without any condition.

I hope the above article helped you a lot to find out the best credit card for you as a low salary person in UAE

If you like the above article please like our other social media platform to appreciate us and spread the knowledge and awareness in UAE to the Workers.