-

HOME

HOME - /

- UAE

- /

- TAXATION

Tax Registration Number in UAE: Importance and the Need for TRN Verification

An Introduction to TRN and VAT in UAE as per FTA

The UAE's fast economic boom and international trade activities have made it necessary for companies to register for Value Added Tax (VAT) in United Arab Emirates. One crucial aspect of Value Added Tax registration is the issuance of a Tax Registration Number (TRN). In this article, we will discuss about what TRN is in the context of the UAE tax system, its importance for businesses running in the region, and why TRN verification is an important process for all the business in UAE.

What is TRN in UAE businesses?

In the United Arab Emirates, the Tax Registration Number (TRN) is a unique identity number for businesses and individuals registered under VAT (Value Added Tax). When the UAE introduced VAT in 2018, businesses with an annual revenue exceeding a certain threshold were advised to register for VAT and obtain a Tax Registration Number (TRN). The TRN is issued by the Federal Tax Authority (FTA) in UAE and is used to identify taxpayers and facilitate seamless transactions. We will discuss about the TRN verification in this article for genuine registered businesses in UAE.

TRN in UAE Value Added Tax (VAT)

An introduction of Value Added Tax in the UAE marked a significant boom in its economic growth. VAT is an indirect tax levied on the consumption of goods and services at each stage of the supply chain. It is borne by the end user or consumer but businesses act as intermediaries by collecting and remitting tax to the government for the government. To effectively implement VAT, individuals and businesses must be registered and get a TRN number so at the time of verification the buyer can pay the VAT after your TRN verification in UAE.

Important Note: You must Verify the TRN number online in UAE before paying any VAT amount.

Why you should Verify TRN?

TRN verification in UAE is a very important process for businesses and individuals engaging in commercial activities in the UAE. There are several reasons why TRN verification is necessary in UAE under Federal Tax Authority (FTA):

Recovery of Input Tax

For all the businesses to claim input tax credits, they must deal with registered suppliers and obtain only valid Tax invoices. By verifying the TRN of their suppliers, businesses can ensure that the input tax they paid is allowed, allowing them to recover the Input Tax amount correctly. Thi sis the reason you must do the TRN verification in UAE.

Recommended read: How to get Gratuity in UAE

Legitimacy and Compliance

Verifying the TRN of a business or supplier is essential to ensure its legitimacy and compliance with the UAE's VAT regulations. Dealing with unregistered businesses and individuals can bring the business to legal problems, financial losses, & damage to organization's reputation in business market. Every business should do the TRN verification in UAE for the legitimacy and Compliance.

Preventing scam & Tax Fraud

TRN verification plays an important role in preventing tax fraud and scam. Fraudulent businesses may attempt to issue fake TRNs or manipulate the VAT system to avoid paying taxes. By conducting TRN verification, the FTA can identify and take strict action against tax violators. This is one of the main reasons to verify TRN number in any emirates of UAE like Dubai or Sharjah.

Avoiding Fines & Penalties

Failing to TRN Verification of suppliers can lead to penalties from the FTA. Businesses are responsible for the accuracy of their tax filings, and if they deal with non-compliant suppliers, they could face penalties for tax evasion or improper documentation.

Importance of TRN in UAE

The Tax Registration Number holds an importance for businesses operating in the UAE and without TRN number you cannot verify the Company's tax Identity:

It is Legal Requirement

Obtaining a TRN is a legal requirement for businesses exceeding the specified turnover threshold. Failure to register and acquire a TRN can result in significant fines and legal consequences. Without TRN number the payee cannot Verify TRN in UAE.

Business Transactions

TRN is essential for businesses engaged in domestic and international trade. You must mention your TRN number on It must be mentioned on all Tax invoices issued to customers and clients, enabling seamless transactions and reducing the risk of disputes.

Building Customer Trust

Having a valid TRN helps build trust with customers and suppliers. It indicates that a business is legitimate, compliant with tax laws, and committed to transparent financial practices.

Government Contracts

For businesses seeking government contracts or participating in government tenders, having a TRN is often a mandatory requirement. It demonstrates the business's ability to fulfill its tax obligations. Using your TRN number someone can easily verify your TRN number.

How to verify TRN Number in UAE?

Step 1 : If you want to verify TRN Number Online than open UAE government Federal Tax authority (FTA) website from given link below-

Federal Tax Authority

or copy-paste the URL in your browser if the above link is not working

https://www.tax.gov.ae/en/default.aspx

Step2: Click on the TRN icon on Right side of the window.

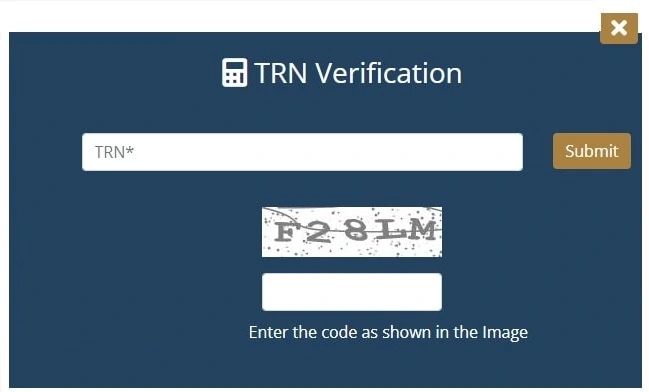

Step 3: You will see a Pop-Up window where you can write the TRN Number which one you want to verify.

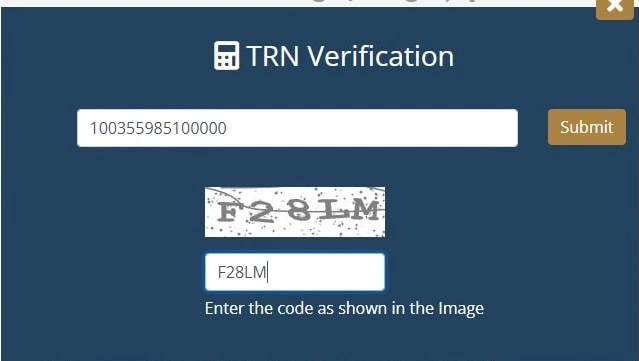

Step 4: Write the TRN Number in verification Box. Write the Code from the above Captcha in the given box like below.

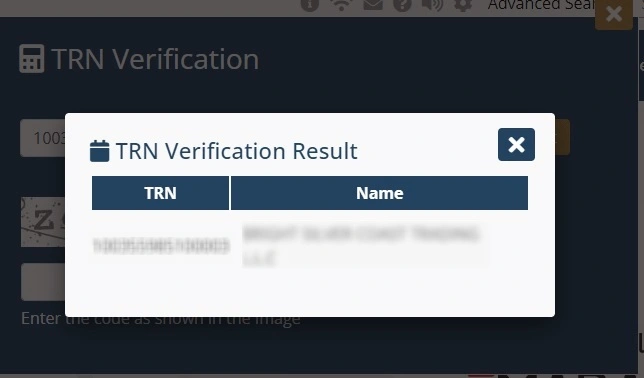

Step 5: After filling the TRN number and Code you will see another Pop-Up window which will show you the TRN Number and Registered Company or individual name just beside of TRN Number. You must match the TRN number with the Business/ Individual name with TRN Number to verify the tax identity.

Conclusion for TRN Number verification

The Tax Registration Number (TRN) is an important component of the UAE's Tax system. It serves as a unique identifier for companies and individuals registered under the VAT taxation system. Verifying TRN is very important to be safe from scams, ensure compliance, maintain accurate financial records, and for transparency to run the business smoothly. Businesses and individuals must do TRN verification to protect themselves from any potential risks, build credibility, and ensure seamless compliance with UAE's tax regulations. By doing so, they can contribute to a thriving and secure business eco system in the United Arab Emirates.

The introduction of VAT in the UAE has not only diversified the country's revenue sources but has also encouraged businesses to adopt more efficient and transparent financial practices. The VAT system has also facilitated the development of a robust taxation infrastructure, allowing the UAE to better manage its public finances and fund essential services and infrastructure projects.

The UAE's commitment to VAT compliance and verification reflects its dedication to upholding international standards in taxation and fiscal governance. This commitment has earned the country a reputation as a reliable and attractive destination for foreign investors.

The UAE continues to grow and develop in the region, the role of TRN and VAT in the country's economic landscape will remain important. Ongoing efforts to promote tax compliance, transparency, and fair taxation will contribute to the sustainable development of the UAE's economy and reinforce its position as a regional economic powerhouse. Businesses and individuals alike must recognize the importance of TRN verification as an integral part of their operations and financial management to thrive in this dynamic business environment.

At the end TRN in the UAE plays an important role in the VAT system and the country's broader economic development. By understanding the significance of TRN, businesses and individuals can make informed decisions, foster credibility, and contribute to the overall growth and stability of the UAE's economy. TRN verification is not a legal requirement but a strategic move to ensure compliance, trust, and success in the UAE's competitive business environment. Embracing the principles of TRN verification will undoubtedly lead to more secure and prosperous business practices for all stakeholders engaged in the business.

I hope the above article helps you to clarify the importance of TRN verification and how to verify TRN Number in UAE.